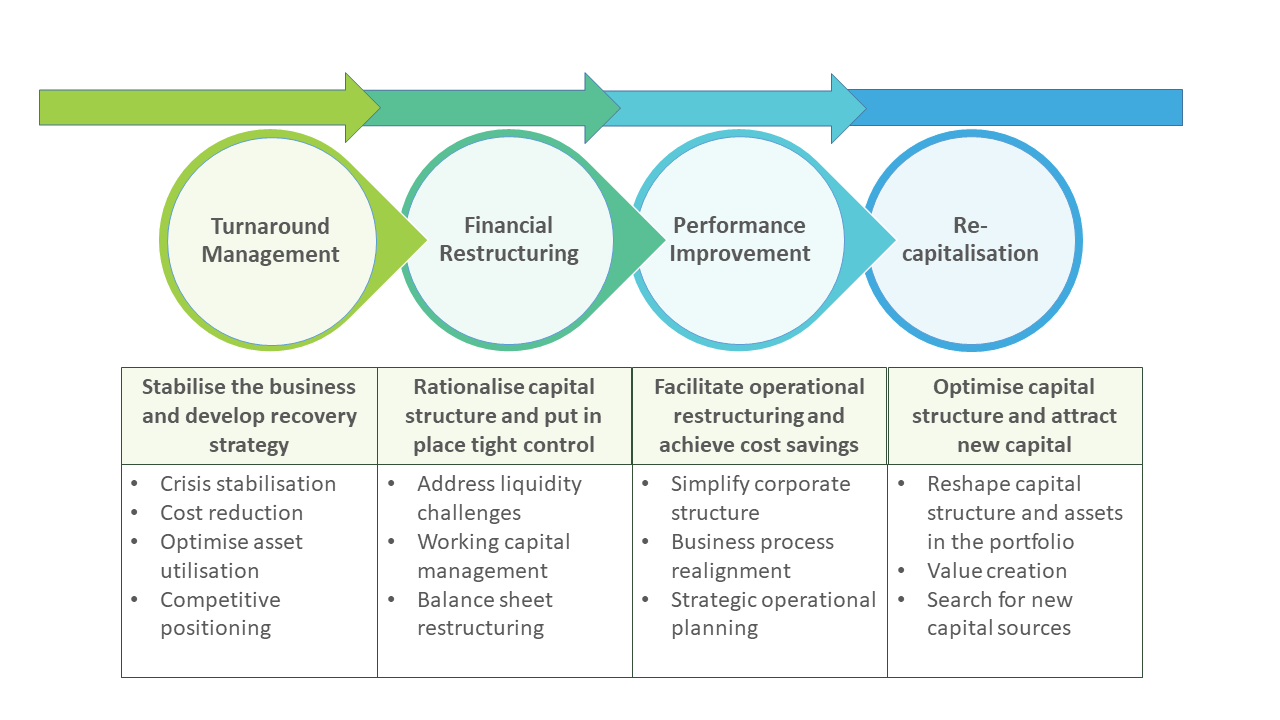

Financial Restructuring

We are specialists, who in our professional capacity, have a lot of experience running financial distressed or under-performing businesses in Singapore and the Asia Pacific. When a company encounters financial difficulties, we are engaged by the lender or the creditor company to advise them on the turnaround, as we understand well the requirements of the different stakeholders – creditor companies, lenders, investors and management teams.

Whether it is Lender Advisory Services or Creditor Advisory Services, we tap on our specialist knowledge of formal liquidation to deliver improved returns to the stakeholders.

What defines our competitive advantage is our professionals being managers who have “hands on” experience in operations. We provide strategic advice on both financial and operational aspects of business. Our operational experience helps deliver improved returns to the stakeholders.

Performance Improvement

Operational issues are the next usual bottleneck faced by companies that are under-performing. Acres is able to assign the most relevant consultants and performance engineers to work closely with the management staff of our clients, to deliver and execute a swift and well-designed plan for turning around the business.

Our team members are experts in the most tried and tested methodologies in business management, utilizing project planning and operational improvement that are customized to the unique business environments of our clients. Every industry, in each of it’s unique environment, culture and country faces different challenges that need to be met with a suitable approach towards improvement.

Acres Advisory can provide guided assistance to your company to develop a bespoke plan to help your business succeed.

For professional advice on corporate recovery and restructuring or financial advisory restructuring services, please contact us today!

Get No Obligations Advice from Our Team

Business Restructuring Strategies

Corporate Recovery

In recent years, businessmen and creditors are more knowledgeable about liquidation laws. Whilst assessing the options for recovery, they have adopted corporate reorganizations, debt-restructurings and formal liquidation procedures to maximize their recovery. Our professionals advise investors, directors, companies and creditors on merits and risks of formal and informal administration. We are experienced and qualified to accept the following appointments: